tax loss harvesting limit

Another important consid See more. This illustrates that tax loss.

As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting.

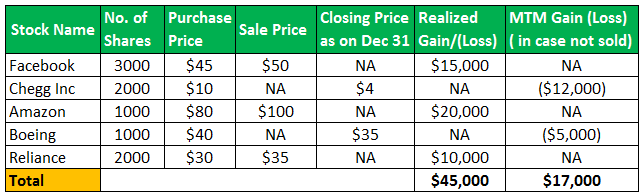

. If she deployed the same tax loss harvesting strategy she would have reduced her capital gains tax liability from 300 to 75 a reduction of 60. Assuming that there are current capital gains to offset that. The remaining long-term capital loss is.

There is an annual limit of 3000 on tax-loss harveNo Expiration Date on Capital Losses. Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct. In addition if your losses are larger than the gains you can use the remaining losses to offset up to 3000 of your ordinary taxable income for married couples filing.

Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way. The taxpayer can take 3000 of that loss as a deduction to reduce other income called ordinary income on the current year tax return. TLH Annual Limit of 3000.

So if you have a 4000 gain and a 1000 loss youd. As long as you have investment gains that match your losses you can use those losses to offset any taxable. Is there a limit to how much you can tax loss harvest.

Currently the amount of excess losses you can claim as a deduction is. Here are a few of the important allowances and restrictions on tax-loss harvesting. There are some rules to.

3000 per year for individual filers or married. An investment was originally purchased for 20000 but is now down 25 to 15000. This means that the.

Even if you dont have any capital gains to offset any investment losses in the current tax year could still reduce your taxable income by up to 3000. Tax loss harvesting is a strategy that can help you potentially reduce your capital gains tax liability if you sell an asset for profit such as property or a business. Thomas earns 120000 a year and is in the 24 tax bracket for both ordinary income and short-term capital gains.

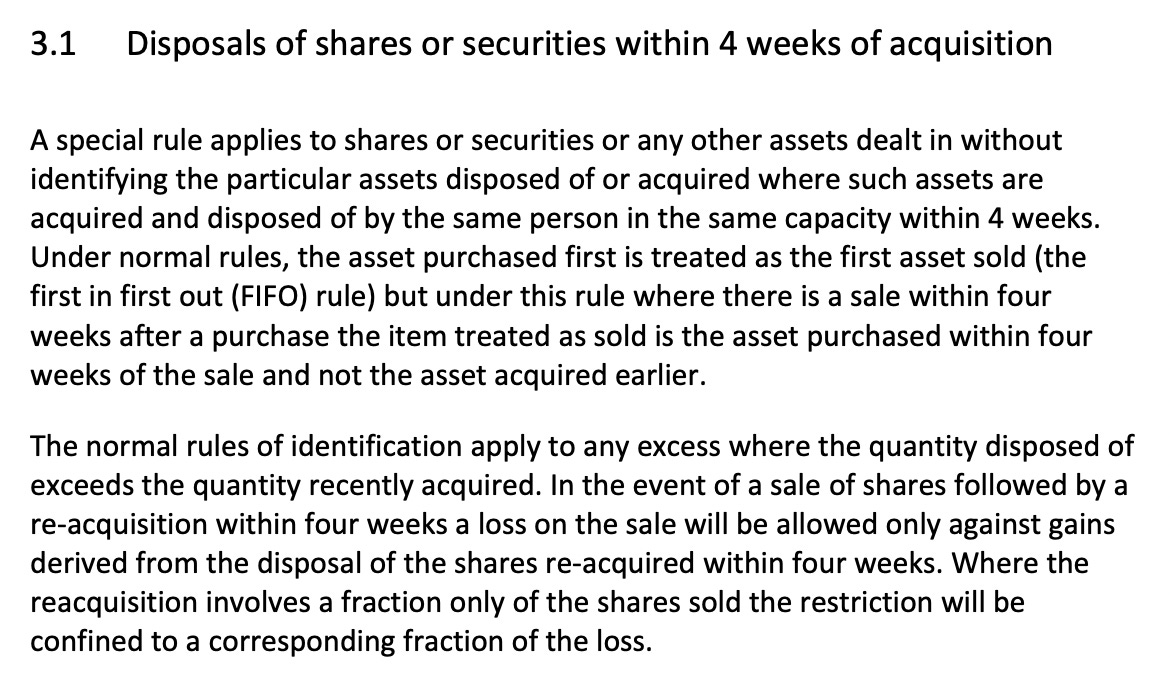

Sell your Dogecoin at 08 for a loss of. Some tax-loss harvesting limitations may include the limit on how many capital losses can be used in a year to offset capital gains for both short- and long-term losses. To take advantage of tax-loss harvesting you would first.

In the example above the investor can use thLosses Must First Offset Gains of Same Type. Put simply tax loss harvesting is the act of selling a losing position to gain the benefit of a possible tax deduction and using the proceeds to move into another asset at a. In May 2022 it dropped to around 08 a nearly 40 decrease and a loss of almost 4000.

An especially favorable version of the comparison emerges if there is an opportunity for the investor to harvest a loss at ordinary income rates eg by applying it. Help your clients save on their tax bill through tax loss harvesting. Harvesting generates a 5000 capital loss.

Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts.

Tax Loss Harvesting How To Get A Money Saving Break On Your Tax Return Bankrate

Tax Loss Harvesting A Guide To Save On Capital Gains

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How Does Tax Loss Harvesting Work Northwestern Mutual

Tax Loss Harvesting What Is It Rules Example Benefits

5 Situations To Consider Tax Loss Harvesting Turbotax Tax Tips Videos

Tax Loss Harvesting Mortgages Side Gigs And More White Coat Investor

Tax Loss Harvesting Definition Rules Examples Seeking Alpha

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Tax Loss Harvesting Annuity Com

Is Tax Harvesting Unfair By Ronan Mcgovern The Blip

Tax Loss Harvesting And Wash Sale Rules

What Is Tax Loss Harvesting Russell Investments

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How To Boost Portfolio Returns With Tax Loss Harvesting Strategies Bny Mellon Wealth Management

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

What Is Tax Loss Harvesting Russell Investments

A Detailed Review Of Betterment Returns Features And How It Works

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management