revvi credit card limit

Earn a credit limit increase after making 5 monthly payments on time within 10 months from account opening when meeting credit criteria. The application is fast and easy and you can even earn cash back rewards on.

Best Credit Cards For Fair Credit In 2022 Build Credit Score

Fast and easy application.

. 3499 INTRO BALANCE TRANSFER APR. 300 credit limit subject to available credit Build your credit score with on-time payments and keeping your balance below the credit limit. Indigo Mastercard for Less than Perfect Credit is related.

Poor Credit Rebuilding. To open your account you have to first pay your Program Fee. Earn 1 cash back rewards on payments made to your Revvi Credit Card.

The Credit One Visa Card can be worthwhile because it gives users a 300 initial spending limit with no security deposit needed in return for up to 99 in annual fees 75 the first year. Fast and easy application. 300 credit limit subject to available credit.

Earn a credit limit increase after making 5 monthly payments on time within 10 months from account opening when meeting credit criteria. Although the Aspire Card does not require a security deposit it does charge an annual fee of 85 - 175 the first year plus both annual and monthly fees after that. Response provided in seconds.

With an unsecured card your credit limit will be based primarily on your credit profile and annual income. This value is considered good and will not impact your credit score. 300 credit limit subject to available credit.

Earn 1 cash back rewards on payments made to your Revvi Credit Card. Response provided in seconds. Opportunity to request credit limit increase after twelve months fee applies.

Specifically the annual fee drops to 29 - 49 after the first year and a monthly fee of 725 - 1250 gets. Dont forget to register your account in our secure Mobile App its the easiest way to manage your Revvi Rewards make payments and more. Once youve paid your Program Fee and you receive your card in the mail you can activate your card here or call customer service at 800 845-4804.

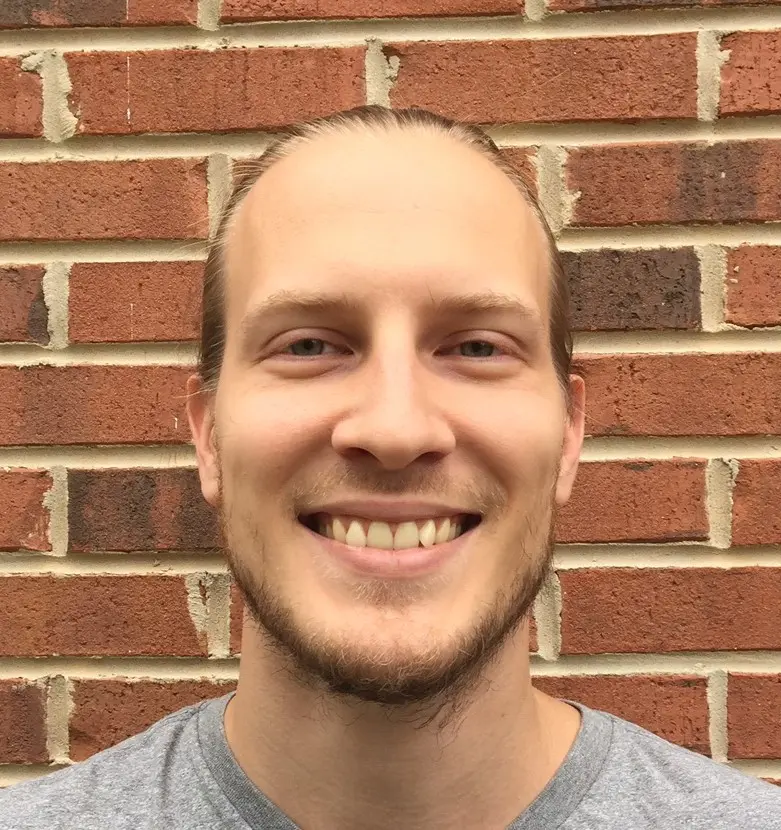

Earn 1 cash back rewards on payments made to your Revvi Credit Card. The Indigo credit cards credit limit is only 300. The Revvi Card is a pretty good unsecured credit card for people with bad credit who want to earn rewards but need to borrow for emergencies.

However the Fortiva Card has an annual fee of 49 - 175 the first year. Choose between 200 and 1000. Credit Limit Increases The Revvi Visa credit card comes with an initial credit line of 300 subject to credit approval.

95 credit card annual. Earn a credit limit increase after making 5 monthly payments on time within 10 months from account opening when meeting credit criteria. Opportunity to request credit limit increase after twelve months fee applies.

Related Credit Card Categories. Poor Credit Rebuilding. Response provided in seconds.

Fast and easy application. 300 credit limit subject to available credit Build your credit score with on-time payments and keeping your balance below the credit limit. If you are approved for the Revvi Card your Account will automatically be enrolled in the Program.

Earn 1 cash back rewards on payments made to your Revvi Credit Card. The Revvi Card offers an initial credit limit of up to 300 subject to available credit with the opportunity to request a credit limit increase after your first year. Free access to your Vantage 30 score From Experian When you sign up for e-statements Initial Credit Limit of 300 1000 subject to available credit Monthly reporting to the three major credit.

Earn a credit limit increase after making 5 monthly payments on time within 10 months from account opening when meeting credit criteria. Response provided in seconds. Cardholders earn 1 cash back on all purchases after paying the cards bill and the card has a 300 minimum credit limit with no deposit needed.

However if your credit card balance is 1500 and your credit limit is 2000 this means your credit utilization ratio is at 75. 300 credit limit subject to available credit Build your credit score with on-time payments and keeping your balance below the credit limit. 3499 INTRO BALANCE TRANSFER APR.

The Revvi Visa Credit Card is issued by MRV Bank and is designed for those of you with a credit score of at least 540. Response provided in seconds. 95 credit card annual.

Other factors that may be considered include how long youve had. 300 credit limit subject to available credit Build your credit score with on-time payments and keeping your balance below the credit limit. Under the Program you are eligible to receive 1 cash back in the form of a statement credit using rewards points earned for payments made on your Account.

After paying the cards monthly cardholders earn 1 cash back on all transactions and the card has a 300 minimum credit card limit with no deposit required. Revvi Credit Card Login Revvi payment. Up to 1000 credit limit doubles up to 2000.

300 credit limit subject to available credit Build your credit score with on-time payments and keeping your balance below the credit limit. Earn 1 cash back rewards on payments made to your Revvi Credit Card. Response provided in seconds.

There is no limit to the total rewards a cardholder can earn. Earn a credit limit increase after making 5 monthly payments on time within 10 months from account opening when meeting credit criteria. The Aspire Credit Card is an expensive unsecured credit card for people with bad credit.

Opportunity to request credit limit increase after twelve months fee applies. 75 1st year 48 after Recommended credit score. 300 credit limit subject to available credit.

3499 INTRO BALANCE TRANSFER APR. While the card comes with certain fees it is quite competitive with cards that are also targeting people with bad credit scores around the mid 500 area. Starting Credit Limit - Your starting credit limit is 300.

Opportunity to request credit limit increase after twelve months fee applies. Poor Credit Rebuilding. Earn 1 cash back rewards on payments made to your Revvi Credit Card.

Opportunity to request credit limit increase after twelve months fee applies. Earn 1 cash back rewards on payments made to your Revvi Credit Card. Simply make your first 6 monthly minimum payments on time All credit types welcome to apply.

With the Revvi credit card you may manage your account online check your statement see transaction history. 75 1st year 48 after Recommended credit score. Earn 1 cash back rewards on payments made to your Revvi Credit Card.

Fast and easy application. Response provided in seconds. There is no limit to the number of rewards.

Depending on your creditworthiness youll be charged with an annual fee of 0 59 or 75 in the first year and 99 after further lowering your available credit. Revvi active cardholders get exclusive access to free Credit Monitoring powered by TransUnion. It also offers cash back rewards and monthly.

Fast and easy application. Earn 1 cash back rewards on payments made to your Revvi Credit Card. While this credit line isnt exceptional Revvi does review cardholder.

Fast and easy application. The Credit One Bank Platinum Visa for Rebuilding Credit is a pretty good unsecured credit card for people with bad credit. Fast and easy application.

For example if your credit card balance is 500 and your credit limit is 2000 your credit utilization is measured at 25. Fast and easy application. Cash back rewards apply towards statement credits to help pay down Revvi Card balances.

Upon credit approval the collateral deposit you provide becomes the credit limit on your Visa card. The Fortiva Credit Card is an unsecured credit card for people with bad credit which means there is no minimum credit score and no security deposit needed. 75 1st year 48 after Recommended credit score.

Response provided in seconds.

Revvi Card 1 Back Perfect Credit Not Required

Revvi Card Reviews Is It Worth It 2022

Revvi Credit Card Review My Honest Thoughts

Revvi Credit Card Vs Fit Card Preapprovals Marketprosecure

Revvi Visa Credit Card Review 2021

9 Credit Cards For Scores Under 600

High Limit Credit Cards In 2022 Credit Land Com

Credit Cards Compare And Apply Online For Credit Card With Myfin

15 Bad Credit Loans And Credit Cards 2022 Badcredit Org

Best Unsecured Credit Cards For Bad Credit In 2022 Bright

Revvi Credit Card Review 2022 The Best Way To Build Your Credit